Divine Feasibility Report Meaning

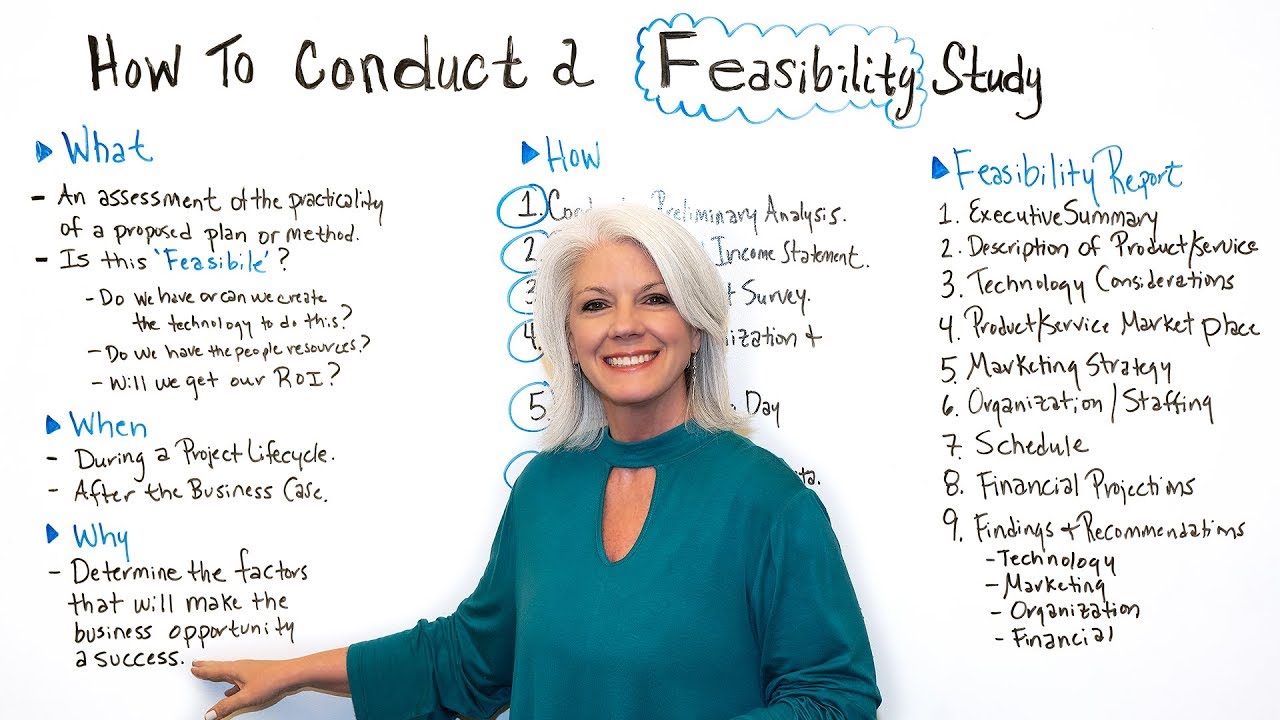

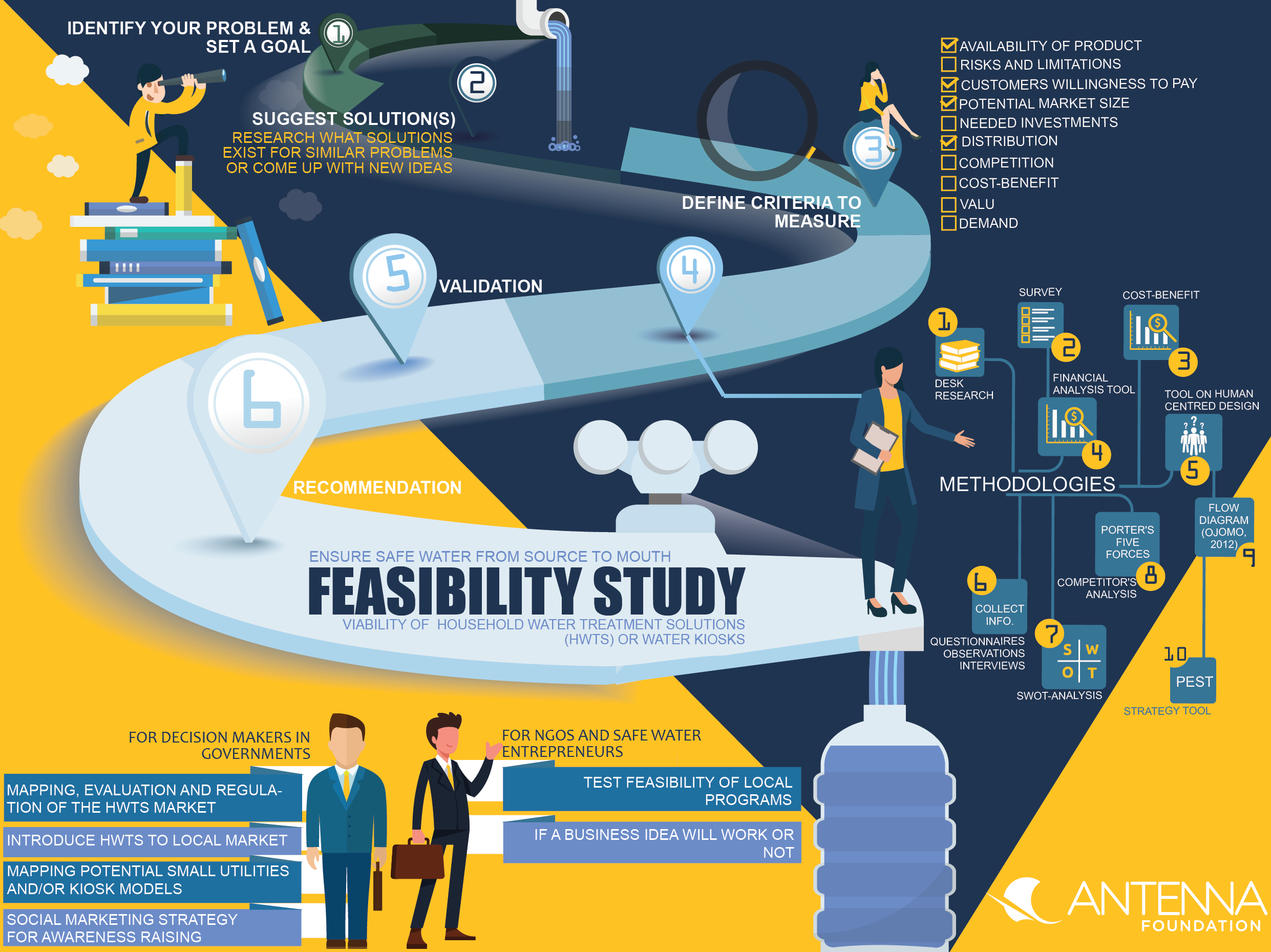

For one the feasibility study is the foundation upon which your project plan resides.

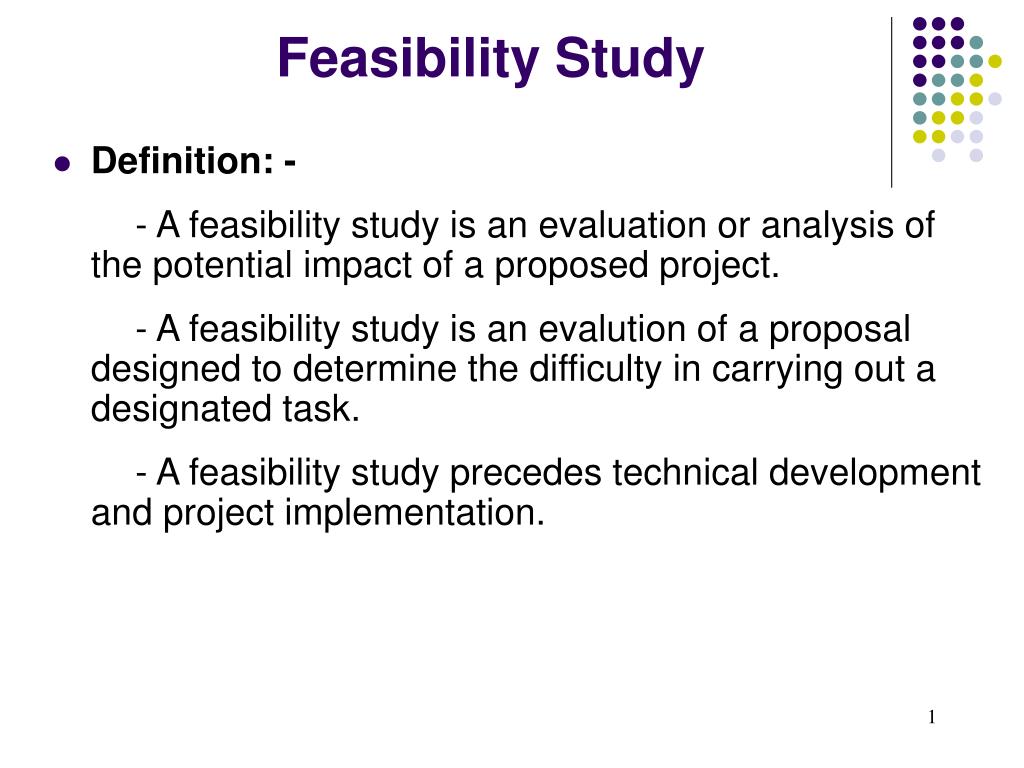

Feasibility report meaning. During this analysis the objectives of the system are defined based on the needed functions described previously. Feasibility study is an assessment of the practicality of. They can also identify potential obstacles that may impede its operations and recognize the amount of funding it will need to get the business up and running.

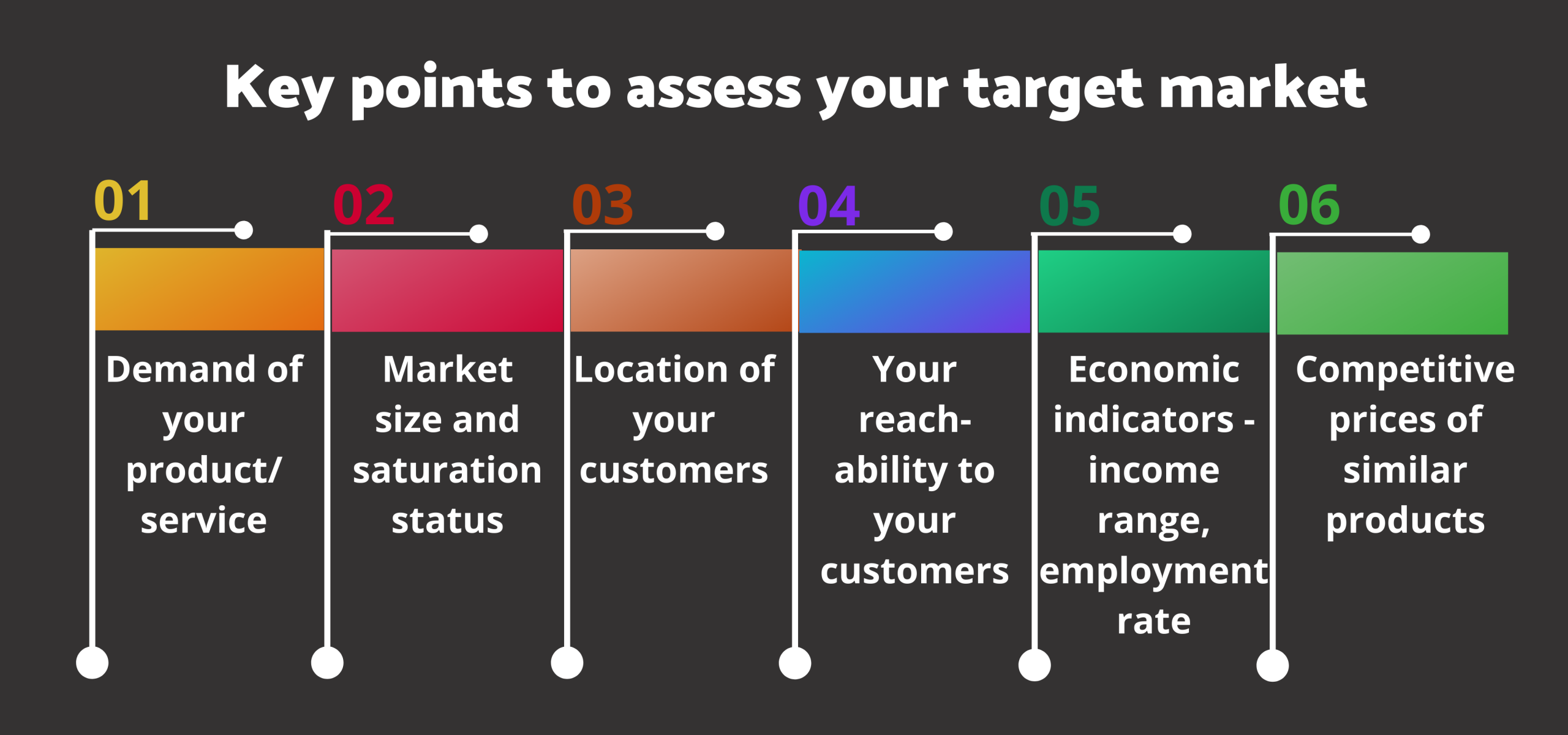

An analysis and evaluation of a proposed project to determine if it 1 is technically feasible 2 is feasible within the. They can allow a business to address where and how it will operate. Information and translations of feasibility study in the most comprehensive dictionary definitions resource on the web.

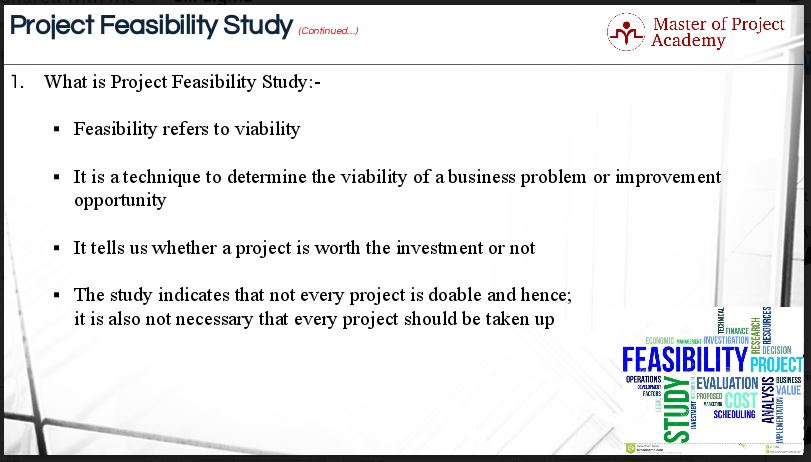

Financial feasibility means the viability of a project after taking into consideration its total costs and projected revenues. A feasibility study analyzes the viability of a project to determine whether the project or venture is. The feasibility study helps.

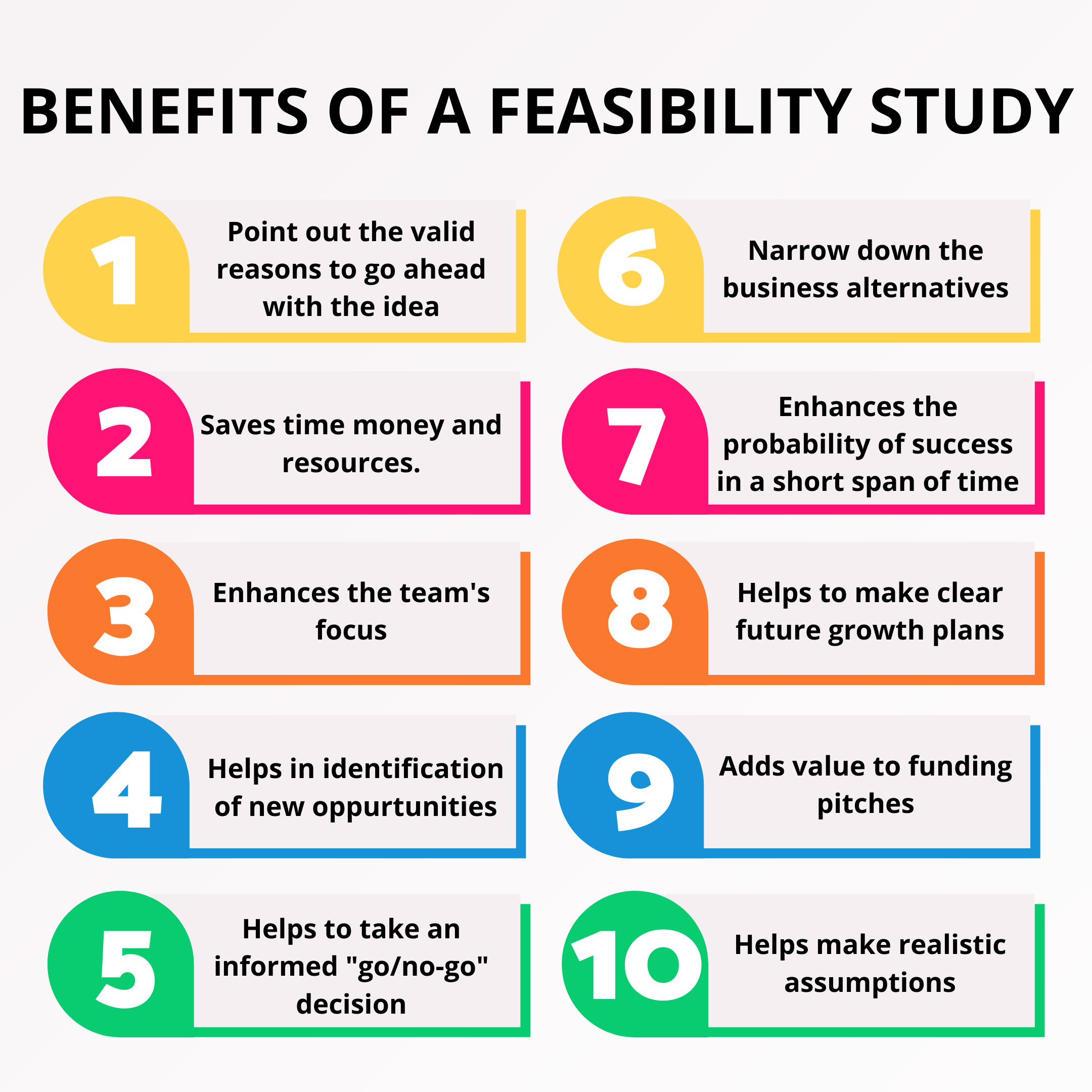

It tells us whether a project is worth the investmentin some cases a project may not be doable. Feasibility studies are almost always conducted where large sums are at stake and are also called Feasibility Analysis. Information such as resource availability cost estimation for software development benefits of the software to the.

If it cant support your project you dont have a project. A feasibility report is the result of a detailed examination of a proposed idea project or business to determine if it is likely to be successful. It also takes into consideration its four Ps its risks and POVs and its constraints calendar costs and norms of quality.

The person who prepares a feasibility report evaluates the feasibility of different solutions and then chooses their recommendation for the best solution. The Feasibility Study is used to provide an analysis of the objectives requirements and system concepts of the proposed system including justification schedule and end products. Some financial institutions require one as part of the loan process.